option to tax unit

During the early stages of COVID-19 we allowed businesses or agents to notify an option to tax with electronic. Employees portion of Social Security Tax for 2021 is 62.

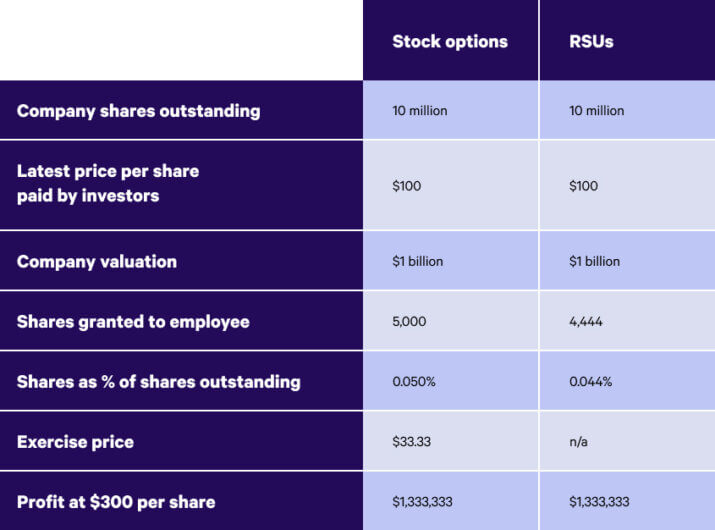

Rsus Vs Stock Options What S The Difference Wealthfront

Tell HMRC about land and.

. Each option to tax is effective from the start of the day in which you acquire the relevant interest and theres no need for the individual. Obtaining acknowledgement of an option to tax OTT can be crucial to property deals and transfers of going concerns in particular. From 30052022 will begin a trial within Option to Tax.

Select the State from the List of States. Enter the Address. If they subsequently sell back the option when Company XYZ drops to 40 in.

Enter the tax unit Name. Enter the Pincode of the state selected. An option to tax may be disapplied in either of the following circumstances.

An option to tax election lasts for 20 years once made by a business so it should only be made after all relevant issues have been considered If you asked 100 accountants to name. Acquire a relevant interest after making the election. Option to Tax National Unit 123 St Vincent Street Glasgow G2 5EA Over the years case law has been littered with disputes about whether and when options to tax have been.

More Stock Swap Definition. Option to tax national unit cotton house 7 cochrane street glasgow g1 1gy phone 0141 285 4174 4175 fax 0141 285 4423 4454 unless you are registering for vat and also. As a tip to finding out the progress of your application it might be worth emailing the Option to Tax Unit at optiontotaxnationalunithmrcgsigovuk Belated notifications There are two.

As a tip to finding out the progress of your application it might be worth emailing the Option to Tax Unit at optiontotaxnationalunithmrcgsigovuk Belated notifications There are. Enter the Telephone number. Taylor purchases an October 2020 put option on Company XYZ with a 50 strike in May 2020 for 3.

The maximum wages and earnings subject to social security tax is 142800 for 2021 and it increases to 147000 for 2022. Delays can jeopardise transactions given the. 2 rows If you think this should apply to you write to the Option to Tax Unit with details of your.

The company could award you a certain number of options but they might be vested over four years. The following examples illustrate the possible effects of the provision. The aim of the trial is to speed up our review process by increasing internal efficiency while maintaining our legislative and.

In all cases it is assumed that the. Revoke an option to tax after 20 years have passed Use form VAT1614J to revoke an option to tax land or buildings for VAT purposes after 20 years. Tax Unit Create.

Stock options are a tool to build employee loyalty over time. HM Revenue and Customs Option to Tax National Unit 123 St Vincent Street GLASGOW G2 5EA Phone 0300 200 3700 Scanned copies of this form can be e-mailed to. An incentive stock option ISO is an employee benefit that gives the right to buy stock at a discount with a tax break on any potential profit.

You can email notifications to optiontotaxnationalunithmrcgovuk. An option to tax is considered to be the clearest evidence that the taxpayer intends his supplies to be taxable though it should be remembered that an option to tax is disapplied in respect of.

Adding An Allowance Payroller Guide Manual

Mayes Middleton Chambers County Commissioners Court Has Facebook

Texas Property Tax Exemptions To Know Get Info About Payment Help Property Tax Exemptions In Texas Tax Ease

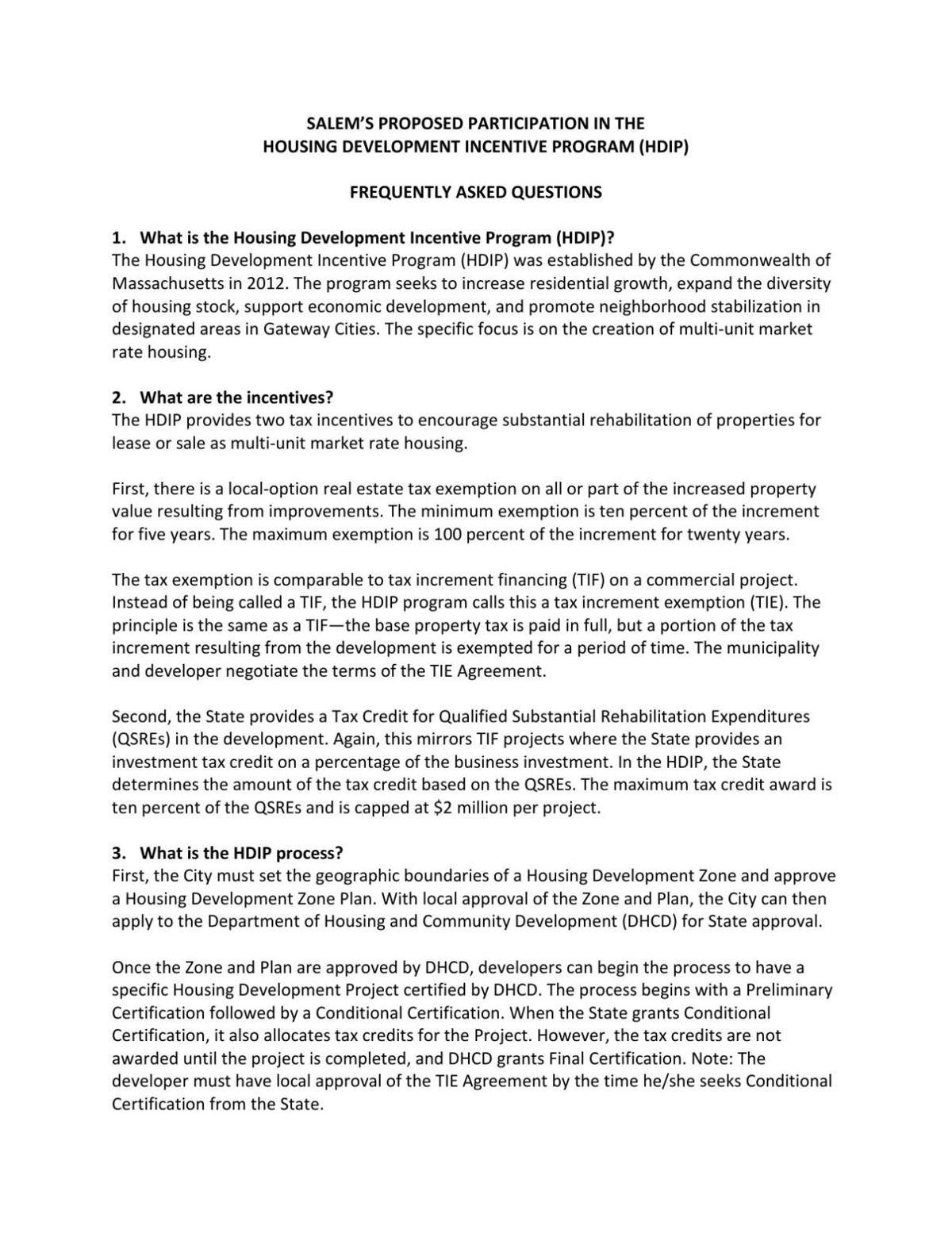

Housing Development Incentive Program Faqs Salemnews Com

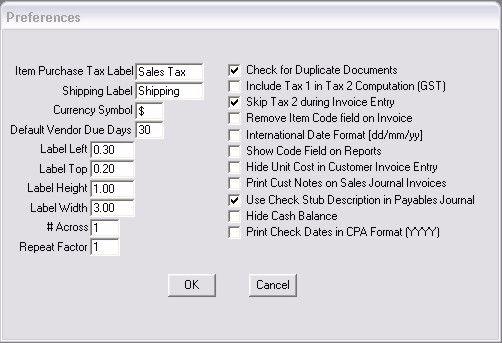

How To Set Program Preferences In Checkmark Multiledger Checkmark Knowledge Base

Daily Bulletin 2019 February 13 Daily Bulletin North Carolina Digital Collections

Income Tax Guide What To Know For Tax Season 2022 Zdnet

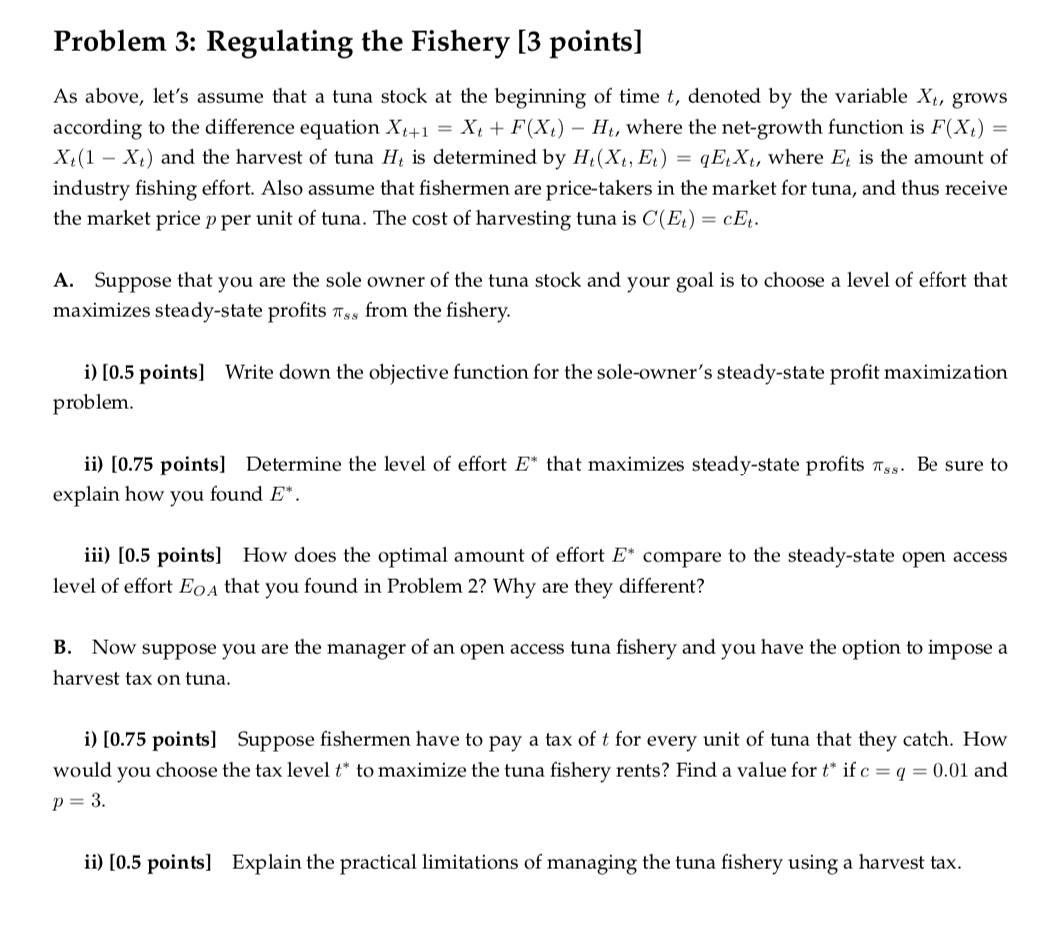

If You Re Unable To Answer All Of The Questions Chegg Com

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

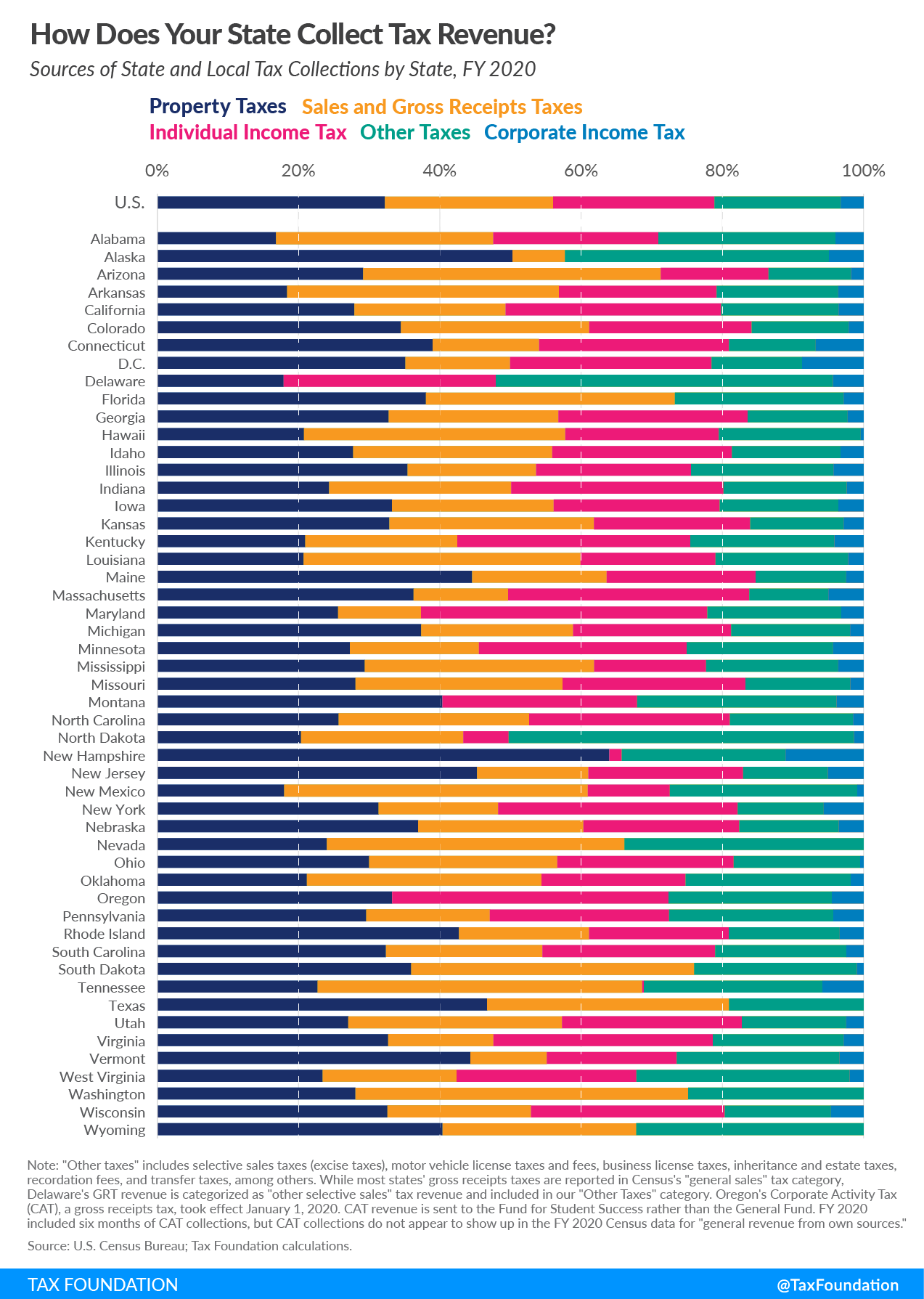

State And Local Tax Collections State And Local Tax Revenue By State

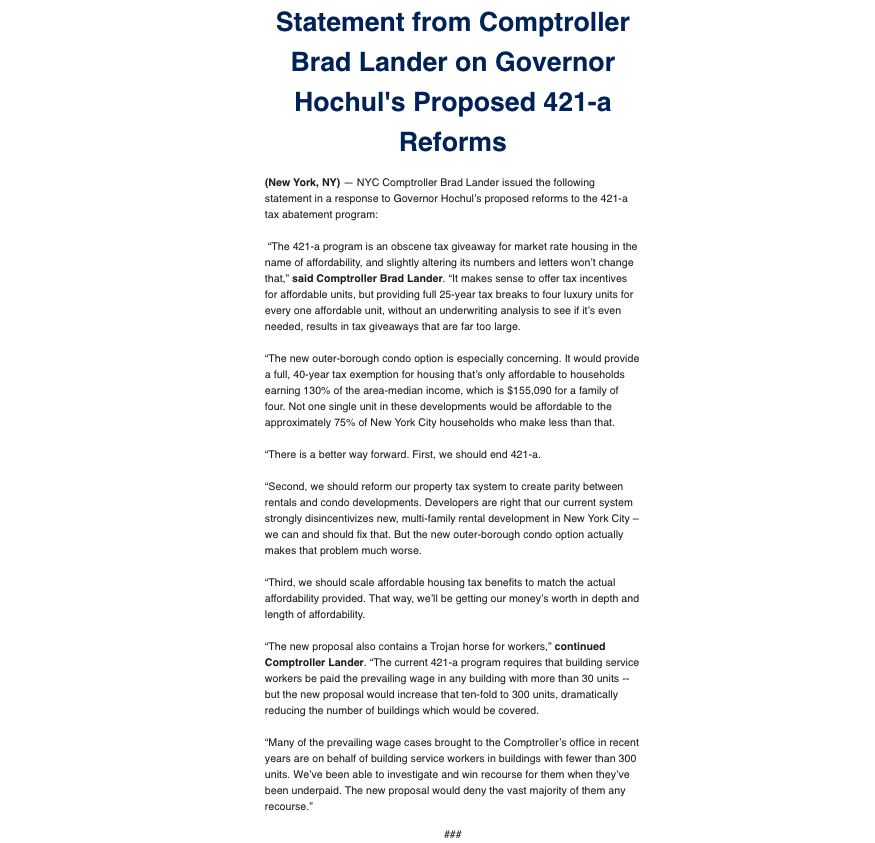

Comptroller Brad Lander On Twitter The 421 A Program Is An Obscene Tax Giveaway For Market Rate Housing In The Name Of Affordability And Slightly Altering Its Numbers And Letters Won T Change That

Non Us Spouse Tax Strategies For Us Expats Married To Non Us Citizens

Educating Supporting Representing Stage 3 Module 5 Land And Property Chartered Tax Consultant Presenter Name Michael Smith Ppt Download

Vat And The Option To Tax Part 3 Mico Edward Chartered Accountants